How to prepare for the U.S. 2022 tax season

Tax season is upon us. Creators who have requested more than $600 USD in payouts in 2022 may be prompted to provide more information by filling out a 1099 form.

If you’ve previously completed the form, but your Tax Exemption Type has changed within the calendar year (for example, from Individual to Corporation) please notify us as soon as possible by emailing creatorhelp@spri.ng.

Note: If you have multiple accounts on Spring, you will need to update your account information for each, as we will be merging your payout amount into one 1099 form.

1. Identify yourself

If you’ve received over $600 in payouts from Spring in 2022, you may be prompted to fill out the tax information form. The first part of the form asks you to identify yourself—this information helps us determine if you need to receive a 1099. See further explanation of each option below:

- Corporation: If you are filing taxes as a corporation.

- Individual: If you are filing taxes as an individual.

- Non-profit: Select this option if you are filing taxes as a 501(c) organization (non-profit organization).

- International: Select this option if you are an international entity (you reside year-round outside of the U.S).

Please note, only individuals will receive a Form 1099. Corporations, partnerships, LLCs, and international entities etc are responsible for reporting taxes themselves by consulting a tax accountant.

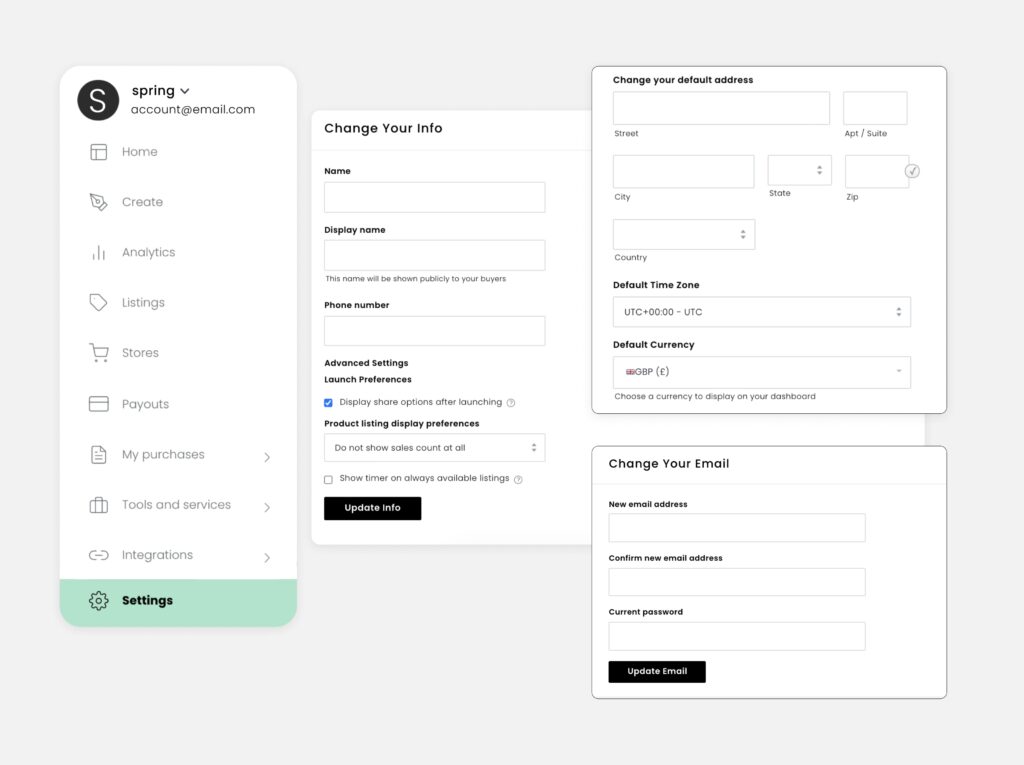

2. Check your account information

Remember you have until Wednesday, January 20th, 2023 at 11:59PM PST to update your tax info within your Spring account settings.

- Make sure your Spring account email is valid (we’ll email you your 1099 form to this email address).

- Make sure the default address in your dashboard under “Settings” is correct.

- Remember to notify creatorhelp@spri.ng if your Tax Exemption Type has changed (for example, from Individual to Corporation).

Make sure your default address reflects your residential address during the calendar year.

If you don’t update your information and do not receive a 1099 form, it’s still your responsibility to file your taxes properly based on your earnings, including earnings from Spring. We cannot provide tax advice—please consult a tax professional.

A link to your 1099 form will be sent to the email address associated with your Spring account by January 31, 2023.